ending work in process inventory calculation

Ignoring work in process calculations entirely. Ending work-in-process beginning work-in-process all manufacturing costs during the period -.

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

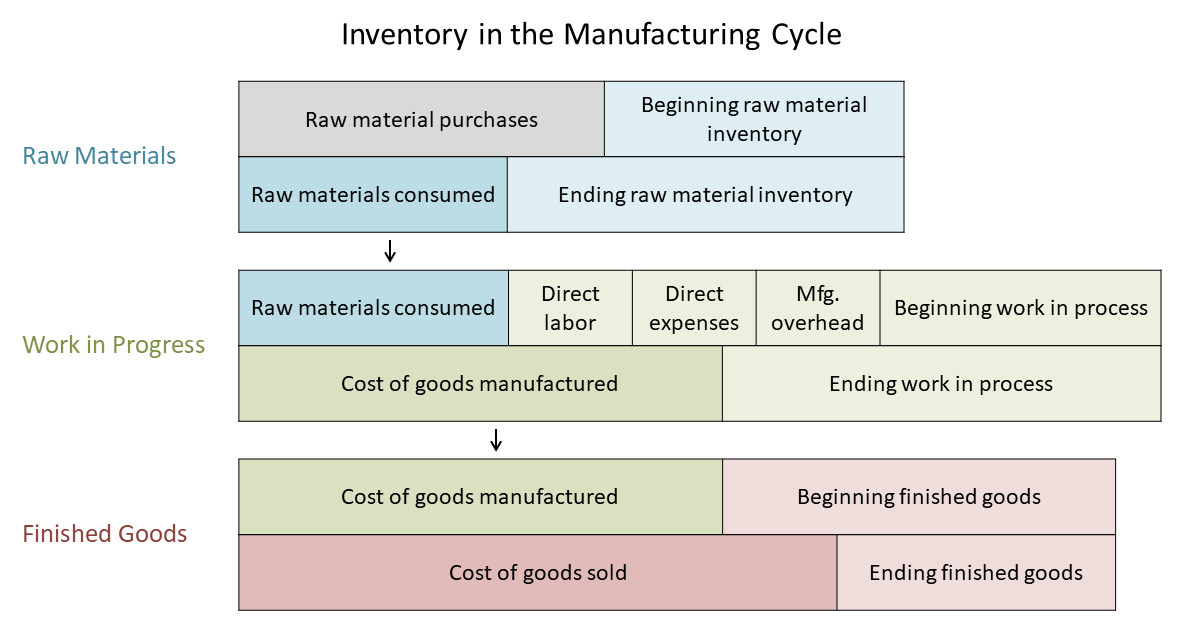

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

. The calculation of ending work in process is. The formula for ending work in process is relatively simple. Multiply 1 expected gross profit by sales during the period to arrive at the estimated cost of goods sold.

How to Calculate Ending Work In Process Inventory The work in process formula is. Multiply the number equivalent units on hand by the value you would assign to finished-goods inventory to determine the balance of WIP inventory. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory.

Usually it is recorded on the balance sheet at a lower cost or its market value. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

Ending Work in Progress WIP Beginning WIP Manufacturing Costs Cost of Goods Manufactured. How do you calculate ending work in process inventory. How to Calculate Ending Work in Process Formula Beginning Work in Process.

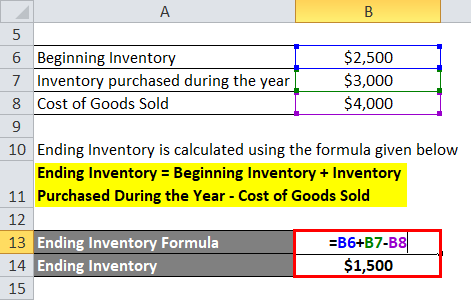

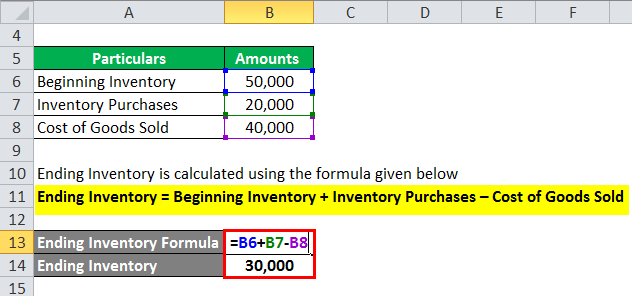

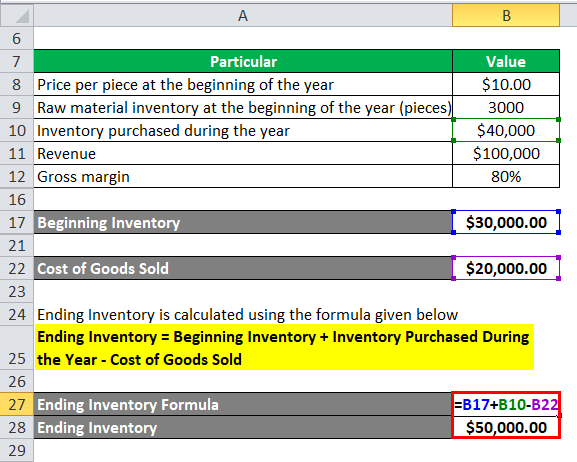

Ending Inventory Beginning Inventory Purchases -Cost of Goods Sold COGS. Formulas to Calculate Work in Process. The closing carrying balance is carried forward as the beginning balance for the next period.

Ending Work in Process WIP Inventory COGM. The formula for calculating the WIP inventory is. Work In-process Inventory Example.

Each accounting cycle starts with an amount for the beginning work in process. The ending Inventory formula calculates the value of goods available for sale at the end of the accounting period. It is important to note that the methods of calculating ending inventory can only be used for estimating the inventory.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. You can do this by adding the cost of your beginning inventory with the cost of all purchases. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process.

In this equation WIP e ending work in process. How do you calculate ending inventory units. Additional Business Financial.

How do you calculate work in process inventory balance. A physical count or a cycle counting program is needed for an accurate ending inventory valuation. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory.

Subtract the estimated cost of goods sold step 2 from the cost of goods available for sale step 1 to arrive at the ending inventory. Formula to Calculate Ending Inventory. Find the cost of goods sold.

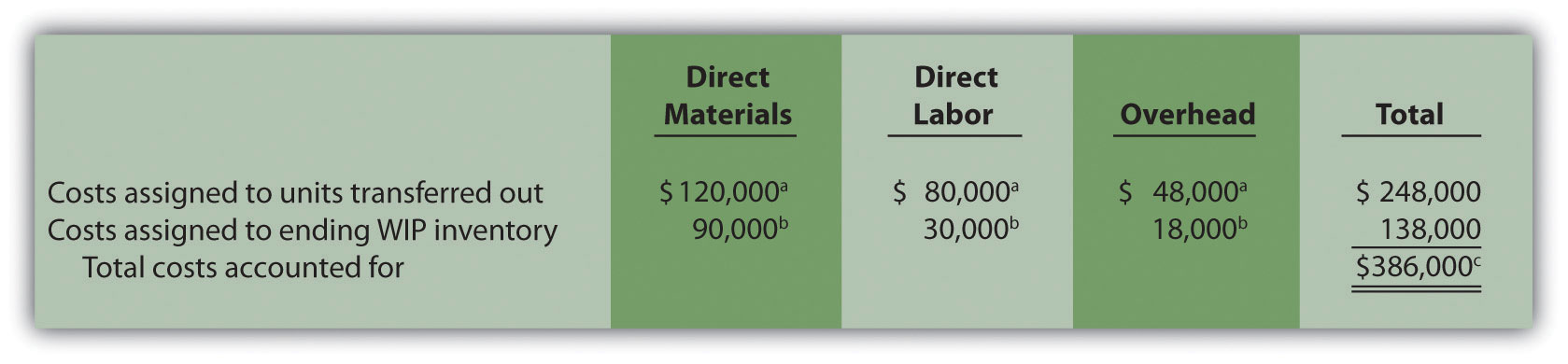

Calculating Your Work-In-Process Inventory. Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account. The process of converting raw materials into finished products costs your company in time and money.

Take a look at how it looks in the formula. Here are the steps for using the gross profit method of calculating ending inventory. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced.

Formulas to Calculate Work in Process. WIP e WIP b C m - C c. Assume Company A manufactures perfume.

The beginning work in progress WIP inventory is the ending WIP balance from the prior accounting period ie. Work in Progress WIP Formula. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have.

The result is the. Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net purchases and subtract the prices of products sold from their sum and you get the value for the ending inventory as shown below. Most businesses that are not run by experienced operations management experts will have too much work in process.

The last quarters ending work in process inventory stands. Find the ending. For example lets say that a company that manufactures furniture incurs the following costs.

To calculate your in-process inventory the following WIP inventory formula is followed. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. It is the total costs transferred from work-in-process inventory to final goods inventory.

Find the cost of goods available.

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

Work In Process Wip Inventory Youtube

Work In Process Inventory Formula Wip Inventory Definition

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing Account Format Double Entry Bookkeeping

Ending Inventory Formula Calculator Excel Template

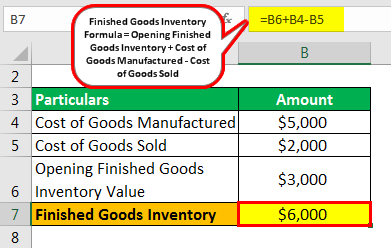

Finished Goods Inventory How To Calculate Finished Goods Inventory

Inventory Formula Inventory Calculator Excel Template

How To Calculate Finished Goods Inventory

Work In Progress Wip Definition Example Finance Strategists

Wip Inventory Definition Examples Of Work In Progress Inventory

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Ending Inventory Formula Calculator Excel Template

Finished Goods Inventory How To Calculate Finished Goods Inventory

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com